Reading time: 2 minutes

The global data center cooling industry is entering its most transformative decade yet. With AI and high‑performance computing (HPC) workloads escalating at unprecedented speed, thermal infrastructure, once perceived as a utility, has now become a strategic enabler of digital growth. Frost & Sullivan views that cooling demand is structurally outpacing data center built‑capacity growth as next‑generation chips push thermal limits beyond what legacy systems can support.

AI Is Reshaping Thermal Design at Its Core

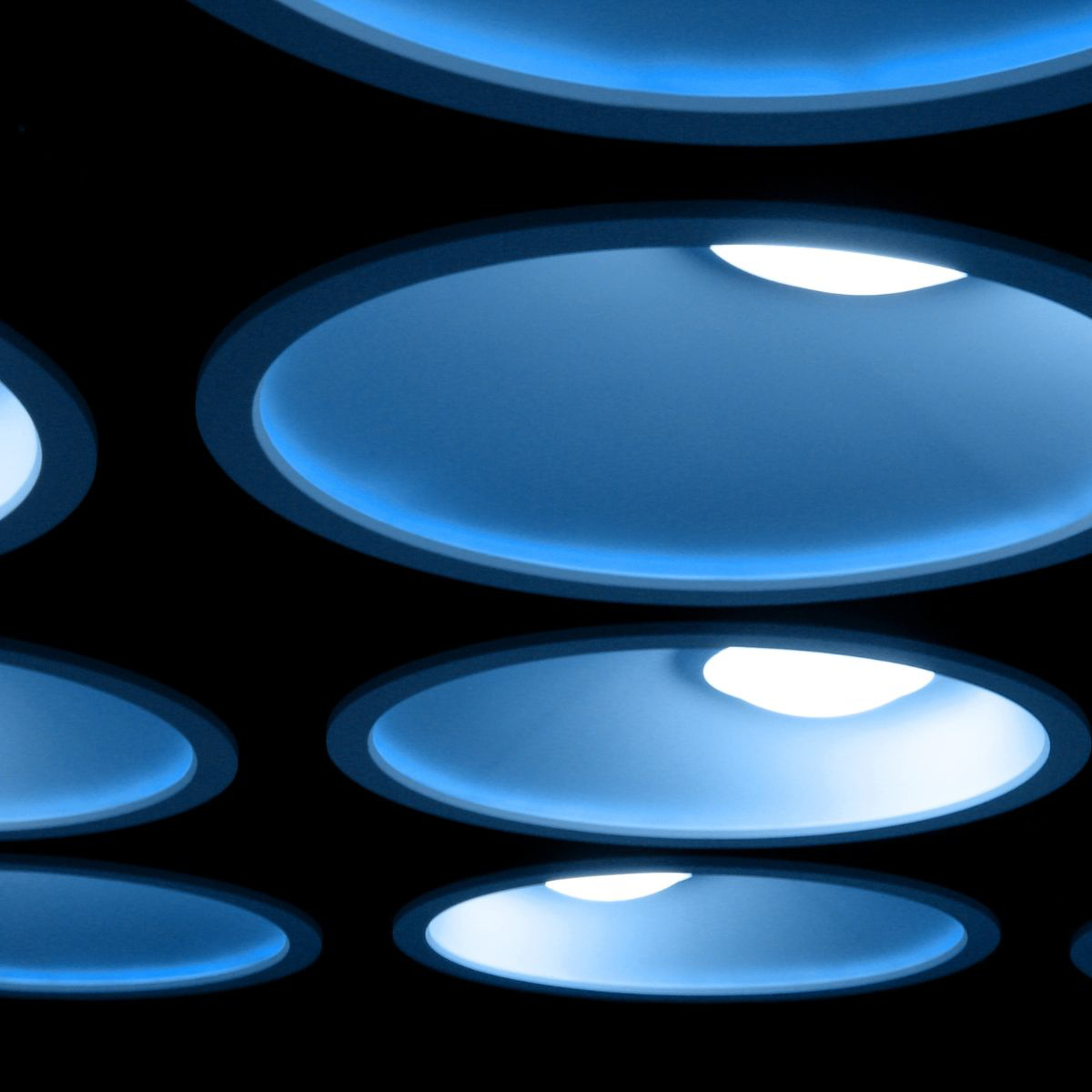

Rack densities driven by AI and accelerated computing have surged into the 800W to 1.5kW per chip era, making traditional room‑level cooling insufficient for hyperscale environments. The research shows liquid cooling entering a multi‑decade adoption curve, not as a hype cycle but as a structural market shift. Direct‑to‑chip architectures are leading the transition, with two‑phase immersion growing in ultra‑dense zones where air simply cannot keep up.

Close‑coupled cooling is emerging as the practical bridge, delivering targeted thermal management for operators who cannot immediately overhaul full facilities. Meanwhile, room‑level CRAC/CRAH systems, while still the largest revenue contributors today, are expected to see share compression through 2030 as newer architectures take hold.

Regional Growth: A Market Fragmenting Into Distinct Demand Curves

Cooling trends are diverging globally, shaping where vendors must concentrate their go‑to‑market strategies. Frost & Sullivan forecasts the data center cooling market to grow from $10.47B (2024) to $52.86B (2034) - a 17.6% CAGR over the period.

North America remains the bellwether for early liquid cooling adoption, driven by the rapid build‑out of GPU‑dense AI clusters and large‑scale retrofits. The region is also the global test bed for immersion cooling pilots and heat‑reuse innovation.

Europe is moving fastest toward sustainability‑led cooling. Regulatory pressure around refrigerants, water usage, and energy efficiency is accelerating adoption of free cooling, heat reuse, and refrigerant‑free systems.

APAC is the highest‑velocity growth region, fueled by hyperscale expansions in Singapore, India, Japan, and Australia. Its diversity creates a dual‑track adoption model: advanced markets shift early to liquid cooling, while emerging markets scale rapidly with high‑efficiency air systems before transitioning.

Four High‑Growth Opportunity Areas

The next decade will be shaped by four transformative growth themes:

AI‑Thermal Platforms & Integrated Cooling Architectures: Demand is rising for unified platforms that combine control systems, workload telemetry, CDUs, pumps, and chillers. Hyperscalers increasingly require AI‑aware thermal orchestration rather than standalone hardware.

Modular & Prefabricated Cooling Blocks: Rapid deployments and infrastructure constraints are pushing operators toward plug‑and‑play cooling modules that accelerate capacity while reducing onsite engineering. This is especially critical in APAC, the Middle East, Africa, and LATAM.

Sustainability‑Led Cooling: Water scarcity and tightening carbon regulations are driving adoption of heat‑reuse, free‑cooling, and refrigerant‑free systems. ESG‑linked procurement is accelerating this shift.

Liquid Cooling Through Vertical Specialization: Industries such as semiconductor manufacturing, scientific computing, fintech, and defence require specialized, OEM‑integrated liquid cooling solutions. Vendors that own these niches will gain disproportionate advantage.

The Bottom Line

Cooling is no longer peripheral and is now central to digital infrastructure strategy. As AI reshapes thermal demands and sustainability reshapes regulation, the industry will reward vendors that innovate in integrated platforms, modular delivery, and liquid‑ready architectures. Those who adapt early will define the next decade of data center competitiveness.

Management Summary

Listen now: your management summary in audio format.